With specialists on the ground in over 40 countries, we provide expert support on local payment preferences, regulations and market conditions. All backed up by the global insights of 27,000 people across the world.

We provide a complete range of payment technologies that cover the entire payment ecosystem, supporting financial institutions, fintechs, corporates and merchants.

Modular Payment Solutions Tailored to Your Needs

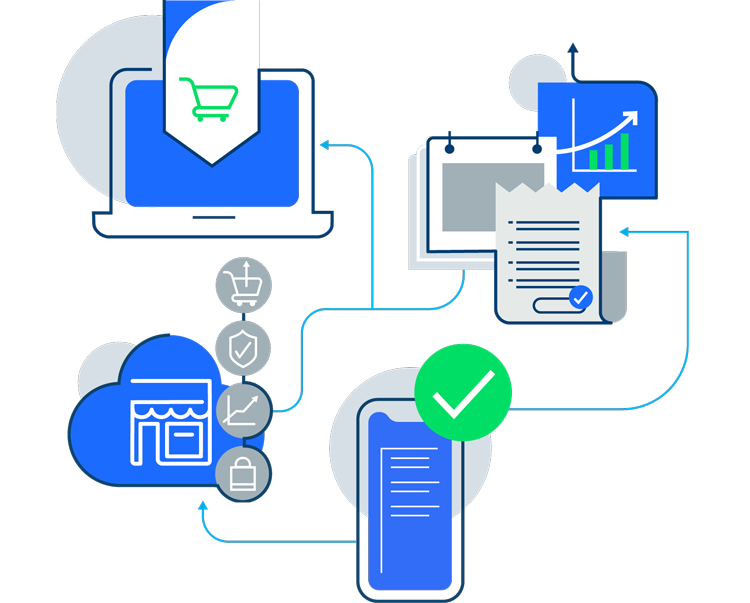

We understand that every client is unique. That's why we offer a modular approach to payment solutions. We can deliver everything from a single, standalone acceptance solution to outsourcing the entire acquiring processing and support services. With our flexibility and expertise, we can tailor our solutions to your specific needs and help you grow your business.

Talk to our experts

Are you a bank searching for an acquirer? We deliver full-service acquiring and processing every step of the way. Authorization and capture, clearing and settlement, risk and compliance, disputes processing, and reporting and analytics. We can handle some of your technology—or all of it.

Get started today

In a world that's always evolving, we’ll keep you ahead. With expertise spanning tech and financial services, we're ready for change when it comes. And you are too.

Ready to learn more?

Talk to our experts